Risk aversion falls, S&P refers to the end of the six-day losing streak, and gold and silver staged a "big dive"

On Monday (April 23rd), EST, after the sell-off of US technology stocks last Friday, US stocks collectively rebounded overnight, and the S&P and Nasdaq ended their six-day losing streak. The easing of the situation in the Middle East made risk aversion fall back, and investors turned to risky assets again. Correspondingly, gold and silver ushered in a sharp correction.

[US stock index]

With the obvious easing of the situation in the Middle East, the market risk appetite has rebounded. On the other hand, after the hawkish remarks of Fed officials "bombed" the market last week, investors gradually digested their remarks, and the core PCE price index favored by the Fed will not be released until Friday, and the market will be able to breathe.

In addition, this week is a heavy earnings week, and giants such as Tesla, Meta, Google and Microsoft will announce the latest earnings results, and the market hopes to welcome them with a positive attitude. Overall, nearly 180 S&P 500 stocks announced their results this week, corresponding to a market value of nearly 40%.

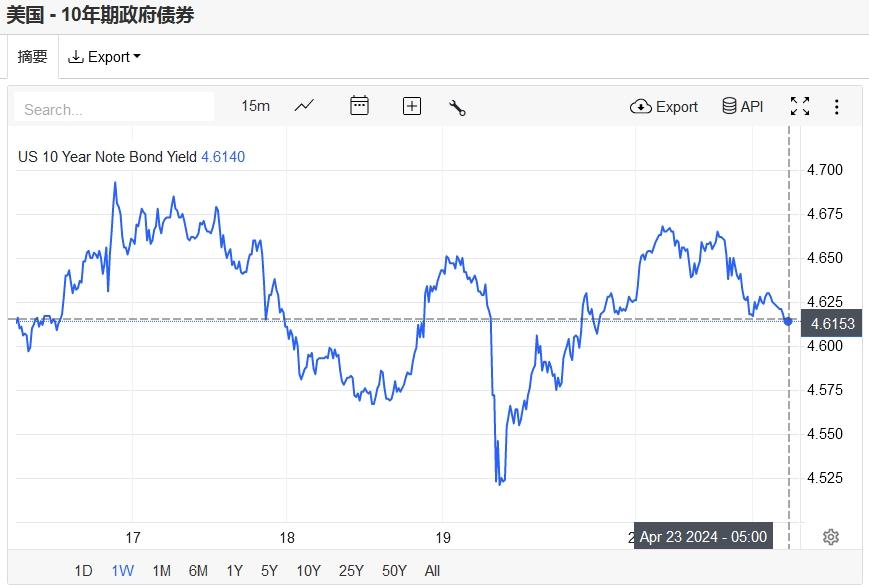

American debt

On April 22nd, the benchmark 10-year US bond yield closed at 4.62%, and the 2-year US bond yield, which is most sensitive to the Fed’s policy interest rate, closed at 4.97%.

[Hot American stocks]

Among the popular US stocks, Microsoft rose 0.46%, Apple rose 0.51%, NVIDIA rose 4.35%, Google A rose 1.42%, Amazon rose 1.49%, Meta rose 0.14%, TSMC rose 1.62%, AMD rose 1.36% and Intel rose 0.61%.

Among them, Tesla fell more than 3% again, and fell for seven consecutive days on the eve of the earnings report. Analysts generally said that they were not optimistic about Tesla’s latest performance after the close of trading today.

In addition, it is worth noting that UBS Group AG said in the latest strategy report that the upward momentum of American technology giants is disappearing, because the profit momentum once enjoyed by this sector is facing cooling down. UBS downgraded the industry ratings of Google, Apple, Amazon, Meta, Microsoft and NVIDIA from "high match" to "neutral".

[global index]

In European stock markets, the FTSE 100 index rose 1.62% to 8024 points. The French CAC40 index rose slightly by 0.22% to 8040 points. Germany DAX index rose slightly by 0.70% to 17,861 points. Among them, the British stock market closed at a record high. The analysis pointed out that the expectation of interest rate cuts in the UK is heating up, which weakens the performance of the pound, but also boosts the financial market including the British stock market.

In Asian stock markets, the Hang Seng Index rose 1.77% to 16,512 points. The index of state-owned enterprises rose 1.47% to 5831 points. The Nikkei 225 index rose% to 37,438.6 points.

[Overseas Market China Index]

Overnight, Hang Seng Technology Index futures rose 1.31%, Nasdaq China Jinlong Index rose 2.34%, and FTSE China A50 Index fell 0.09%.

[China Stock Exchange]

In terms of popular Chinese stocks, Tencent Holdings (Hong Kong stocks) rose by 5.46%, Alibaba by 2.33%, Pinduoduo by 9.38%, Netease by 1.47%, Baidu by 2.30%, Ctrip by 2.81%, LI by 5.57%, Weilai by 5.40% and Xpeng Motors by 0.79%.

[foreign exchange commodities]

The picture shows the real-time market as of press time.

The US dollar index continued to strengthen in the Asian and European markets, and then weakened during the US session due to the retreat of risk aversion, and finally closed down 0.004% to 106.12.

The price of gold hit its biggest one-day drop in the past two years, and COMEX gold finally closed down 2.72% to $2,327.43 per ounce; COMEX silver finally closed down 5.31% to $27.15 per ounce.

According to the analysis, with the easing of geopolitical tensions in the Middle East, the demand for hedging has decreased, and traders are concerned about the US PCE data to be released this week, the price of gold has declined. However, although the market expects the gold price to enter the consolidation period, UBS believes that any price correction is an opportunity for investors to increase their holdings of gold, and the persistence of geopolitical risks may provide support for the gold market in the long run.

As part of the premium brought by the Middle East conflict continued to fade from the market, WTI crude oil closed down 0.24% to $82.02/barrel; Brent crude oil closed down 0.16% to $87.15/barrel.

[Highlights]

Rieder, BlackRock investment officer, thinks the Fed has room to cut interest rates twice this year.

Rick Rieder of BlackRock believes that bond investors who have been tortured by rising yields this month may soon find some comfort from slowing inflation and the Federal Reserve. In an interview, the global fixed income chief investment officer of this asset management company predicted that the Fed is expected to cut interest rates twice this year as inflation slows down in the coming months.

JPMorgan Chase strategist: There may be room for further decline in the US stock market.

JPMorgan Chase strategists believe that the three-week losing streak of US stocks has not ended for many reasons, including rising bond yields, high oil prices and high stock market concentration. Marko Kolanovic, the bank’s chief market strategist, and others wrote in a report sent to customers on Monday that about 40% of American companies reported earnings this week by market value, and the price changes may depend on the earnings report, which may stabilize in the short term. "However, we think the selling will continue."

Self-developed end-side large model of Apple’s AI competition

On Monday, Mark Gurman, a well-known science journalist, broke the news that Apple is developing a large-scale language model (LLM) running on the device side, which will give priority to ensuring response speed and privacy protection. Gurman said that this model will become the basis of Apple’s future generative AI function, and it will run entirely on devices, not in the cloud.

Tesla’s marketing team, which was established only four months ago, was all laid off.

At the weekend, some media said that Tesla’s actual layoffs may exceed 20,000. Musk believes that the layoffs should reach 20%, instead of more than 10% reported by the media last week that he told the company’s employees.

UBS downgraded the "Big Six" of American technology stocks.

In the latest strategy report, UBS Group AG said that the upward momentum of American technology giants is disappearing, because the profit momentum once enjoyed by this sector is facing cooling down. UBS downgraded the industry ratings of six technology giants, namely Alphabet, Apple, Amazon, Meta, Microsoft and NVIDIA, from "high match" to "neutral".

Jonathan Golub, strategist at UBS, said that the profit kinetic energy turned to negative after the sharp increase in profits, and the downward adjustment was "an acknowledgement of the difficulties and cyclical power constraints faced by these stocks" rather than "a forecast based on the expansion of valuation or a suspicion of artificial intelligence".

Meta announced that it will open the VR operating system to external companies.

Meta announced on Monday that it will cooperate with Lenovo, Microsoft, Asus and other external hardware manufacturers to create a virtual reality headset using Meta Horizon operating system. This also enables the equipment of external manufacturers to run the same system as Quest 3 and Quest Pro.

Zuckerberg said that the company’s goal is to let the open mode define the next computing era together with the meta-universe, glasses and head-mounted devices. He also said that Meta will allow Steam and Microsoft’s Xbox cloud games to run on its operating system.